Avail Best Stock Market Courses in Delhi from Ruchir Gupta Training Academy

Before delving into what the stock market courses have to offer, we will delve a bit into the d

Read More

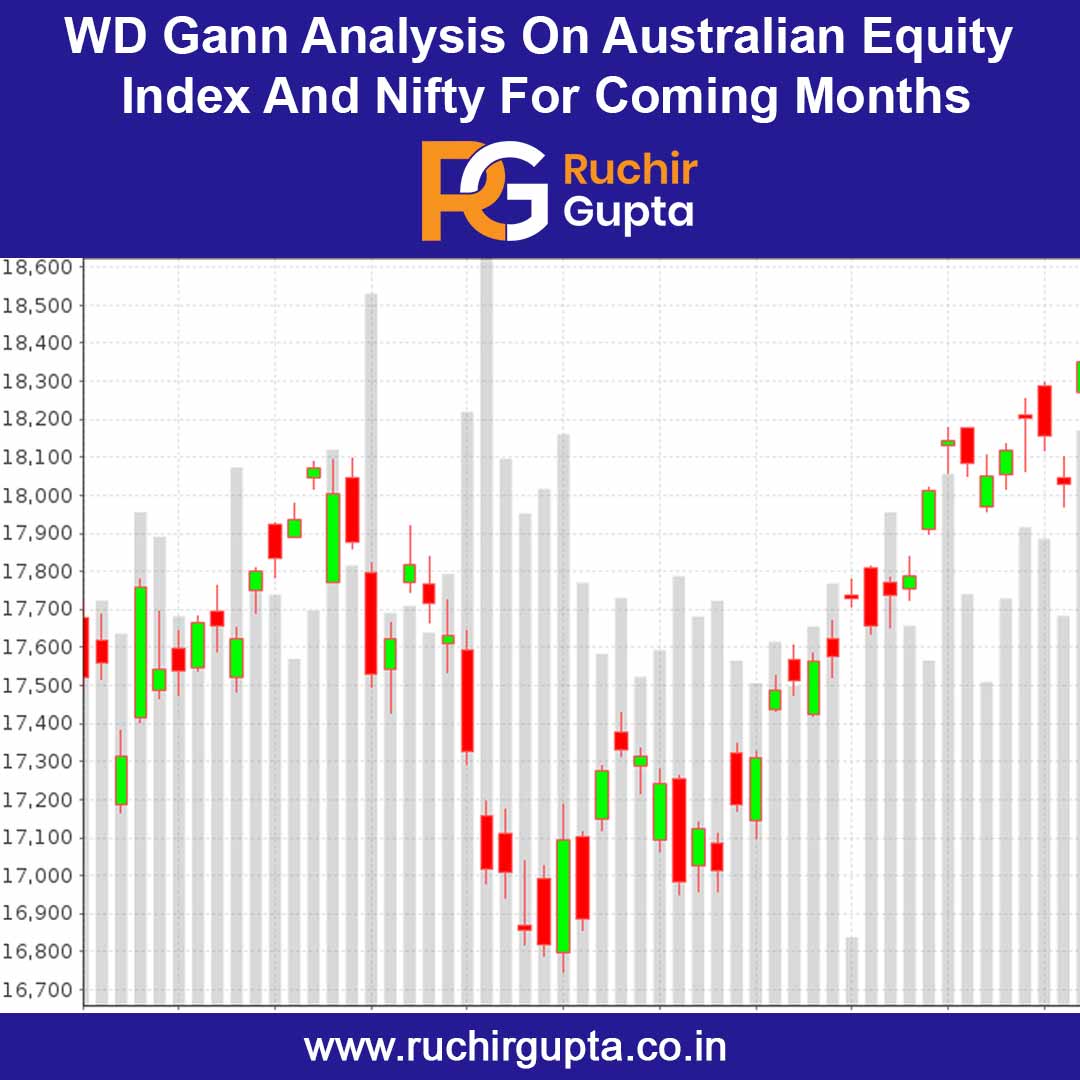

Australian Markets: As per my WD Gann Analysis and Study of Time Cycles, Australian All ordinaries Index (XAO) is going to fall till at least 17 April 2017. To complete the fall of 10% the time might extend till June 2017. My Time Cycles indicate the intensity of fall is going to be severe and the index might fall 5- 15%. I would say it will very easily fall 550- 600 points. The support zone is 5300 to 5220. Which is 10% below the present high of 5880 of Australian Equity Index.

I came across this analysis while teaching a WD Gann Analysis Course to one of my Australian Student, the research was in-depth so I am very sure of my analysis. Please refer to the chart as they are just for educational purpose only.

Indian Markets: As per my WD Gann Analysis and Study of Time Cycles, Indian indexes Nifty and Sensex will also fall, however the severity will not like be Australian All Ordinaries Index. Indian Indexes might also bear the brunt of global melt down and could fall till 20 April 2017. Falling from 9210 to 8800, will be only 400 points correction or 4.5% correction as compared to Australian Index as I feel that Indian Nifty should outperform Australian Index.

Before delving into what the stock market courses have to offer, we will delve a bit into the d

Read MoreWe have become the best institute for Online Stock Market Training in Delhi and this has cement

Read MoreRuchir Gupta Training Academy has emerged as the best Stock Market Training Institute in Delhi.

Read MoreA share market is a place where stocks are either issued or traded. A share market is similar t

Read MoreStock trading and understanding the stock market is accessible to anyone. There are many ways y

Read MoreHumanity was revolutionized by books. Individuals were able to borrow knowledge from others. An

Read MoreAs a prominent Stock Market Trainer, Ruchir Gupta provides training in various stock market tactics through his specialised courses.

It takes at least 6 months to learn swing trading and at least a year to learn intraday trading. So do not be discouraged by the time commitment; this is a talent that will pay you for the rest of your life. There is no such thing as retiring in trading since you may trade from the comfort of your own home even if you are 80 years old.

The approaches of Ruchir Gupta are applicable not just to the stock market but also to the currency (Forex) and commodities markets. His students originate from all over the world, including well-known countries like the United States, Europe, Australia, and Thailand. He is well-versed in a wide range of asset types.

Since joining the Trading World, Ruchir Gupta has seen that no matter how large the trading sector becomes, there is a shortage of learning advice and suitable mentorship assistance. Students buy the course regardless of who they buy it from, and there is no community support as such. With this in mind, he launched the GCD Facebook Group and GCD Telegram Discussion Group, where students can engage and fast learn.

Market timing is the act of shifting investment money into or out of a financial market based on prediction procedures, or exchanging funds between asset classes. If investors can forecast when the market will rise and fall, they can execute trades to profit from that market movement.

Comparable vocabulary" Stocks" is the more broad, generic phrase of the two. It is frequently used to denote a stake in one or more enterprises. In contrast, "shares" have a more specific purpose in common parlance: it frequently refers to ownership of a certain corporation.

1 Comment:

such a kind and considerate blog, and the details you offer here are really beneficial to new visitors.